If you're a regular shopper at Walmart and you want to have a more convenient experience, there is an app that will help you to manage your finances while also making shopping at Walmart better, the Walmart MoneyCard app.

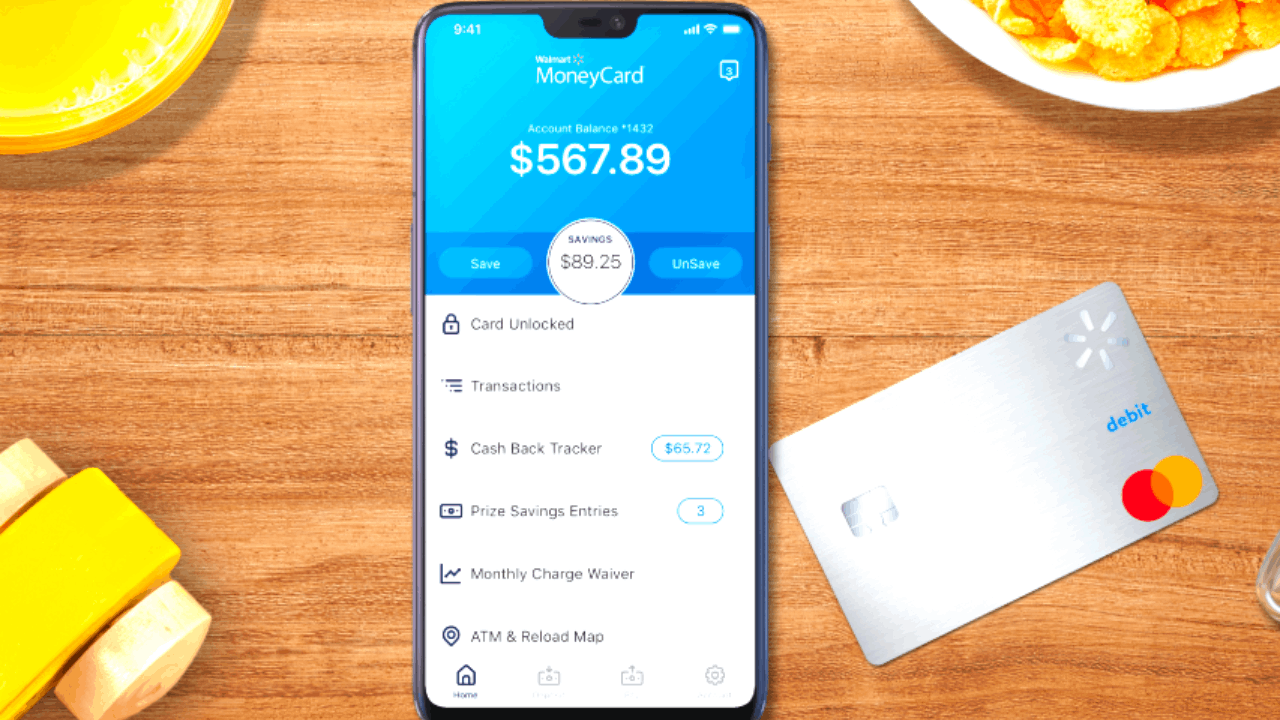

With this easy-to-use app, you can manage and track your spending, access real-time account balance information, and securely transfer funds from the convenience of your mobile device. Whether you're looking to pay bills online or make a purchase from an authorized retailer, the Walmart MoneyCard app has you covered.

Get started today and experience the power of convenience with Walmart MoneyCard. Learn more about the app and how you can apply for a credit card in this article.

The Perfect Way to Shop with the Walmart MoneyCard App

Whether you’re just starting out or already have an established financial history, the Walmart MoneyCard App makes managing finances easier than ever before. The app is a convenient and secure way to manage your money.

With it, you can easily make purchases anywhere Debit MasterCard® or Visa® debit cards are accepted in the US, including ATMs, stores, and online merchants. You can also use it to pay bills, view past transactions, set up direct deposit, and more.

There are a wide range of features available when you use the Walmart MoneyCard app. From earning cashback to managing your finances, you have everything you need to shop at Walmart using the Walmart MoneyCard app.

Download the App and Get Your Credit Card in a Flash

To apply for the Walmart MoneyCard from the Walmart MoneyCard app, you first must download the app to your mobile device from the Google Play Store or the Apple App Store. After downloading, create an account and sign in. Tap “Apply for a Credit Card” from the main menu of the app.

Provide all the necessary information including your name, address, email address, and many other details. Answer a few more questions that may appear on the application form.

Make sure to review the terms and conditions associated with applying for the credit card before you submit it. Wait for the notification to know if you're approved. If you are approved, you will receive further instructions on how to activate your new credit card account.

Get Rewarded for Shopping with the Walmart MoneyCard App

One of the most popular features of the Walmart MoneyCard app is its cashback program, which allows customers to earn rewards for every eligible purchase made with their MoneyCard.

With the cashback program, customers can earn up to 5% cash back on all eligible purchases. This includes 3% on Walmart.com, 2% at Walmart fuel stations, & 1% at Walmart stores, up to $75 each year.

The money earned from these rewards can be used towards future purchases or can be withdrawn as cash at any Walmart location in the US.

To take advantage of this feature, simply activate it within the app and then make sure you’re using your MoneyCard whenever you shop at participating stores or websites. The amount awarded will appear in your account instantly after each purchase and you can withdraw them as soon as they are available.

Walmart MoneyCard's Generous Annual Interest Rate

You can easily access your account and manage your money using the Walmart MoneyCard app. When you open a Walmart MoneyCard account, you will receive an annual interest rate of 2%. This rate applies to all balances over $1,000 in the account.

The more money you save in the account, the higher the interest rate you will earn. Your deposited funds are FDIC-insured up to $250,000 per depositor for added security and peace of mind.

If you're looking for an easy way to earn interest while securely managing your finances with ease and convenience, then consider opening a Walmart MoneyCard account today!

Deposit Your Cash Instantly at Walmart

Using the Walmart MoneyCard app to deposit cash at Walmart stores is a convenient and secure way to manage your money.

This service allows you to quickly transfer funds from your bank account or debit card directly into your Walmart MoneyCard, all without having to wait in line or worry about carrying large amounts of cash around with you.

Simply log in to the app so you can add funds by selecting Add Cash on the main menu. From there, select “Cash Deposit” and enter the amount of cash that you want to deposit into your MoneyCard. You will then be asked for verification before you're given an 8-digit code that needs to be entered at any participating Walmart store checkout lane.

At the store, let the cashier know that you would like to make a deposit using your 8-digit code and provide them with your cash payment. The amount will then be credited into your MoneyCard wallet within minutes so that it can be used for purchases or ATM withdrawals right away.

Say Goodbye to Those Pesky Fees

The Walmart MoneyCard app allows you to track your purchases and make online payments, all without a monthly fee. This makes it a great option for anyone looking for an alternative to traditional banking.

You'll have no monthly fee when you have more than $500 on your account and if you don't have the amount, you'll be charged $5.94 a month. Don't worry though as it will be waived when $500 or more is directly deposited in the previous monthly period.

Add Your Loved Ones to the Walmart MoneyCard Squad

The Walmart MoneyCard app makes managing multiple accounts easy so that you can keep track of everyone in your family without having to worry about keeping paper records or visiting multiple banks in person.

To order cards for your family, log into the Walmart MoneyCard app and select the Accounts tab. Tap “Add Family Member” and enter their name and address information along with their date of birth. Once all of their information is entered, choose “Create Account” and then review the terms of service before accepting them.

Once this process is complete, you will be able to manage each family member’s account within the app by checking balances, setting up direct deposit payments, transferring funds between accounts, and more.

You can also easily monitor spending activity on each cardholder's account with real-time alerts sent directly to your device whenever there is a transaction made using a linked card or account number associated with one of your family member's accounts.

Never Worry About Overdrafting Again

The Walmart MoneyCard app offers a feature that allows you to link your MoneyCard account to an eligible checking or savings account. In case you're short on funds, it will automatically draw the funds from the linked account. This helps to make sure that you never get hit with an unexpected overdraft fee and instead keeps your finances secure.

The Overdraft Protection feature of the Walmart MoneyCard app is very easy to set up. Simply log into the app and select “Overdraft Protection” from the settings menu. You can then select which bank account you would like to link your Money Card to and confirm by providing some additional information about both accounts.

After this is done, all purchases made using the card will be checked against both accounts before being approved, so even if there isn't enough money in one account, it will still be able to draw money from another linked account if necessary.

Stay in the Loop with Walmart MoneyCard App Updates

Stay up-to-date with your financial information by using the Walmart MoneyCard app. The app provides real-time notifications regarding all activity on your card, including deposits, withdrawals, purchases, and balance inquiries.

To receive account updates using the Walmart MoneyCard app, tap the Accounts tab at the bottom of the page. This will bring you to a page that displays all of your accounts associated with this card including their respective available balances.

If you want to keep track of all activity, you can enable Push Notifications by selecting Settings from the menu located at the top right corner within the Accounts tab on iOS or the side menu on Android devices. Now you will be notified immediately via push notifications sent directly to your device's home screen.

Lock Up and Leave Your Worries Behind

The Lock feature on the Walmart MoneyCard app provides a convenient way for customers to protect their funds if their card is lost or stolen. With the Lock feature, users can temporarily disable their card from being used until they find it or get a replacement.

To use this feature, you simply need to open up the Walmart MoneyCard app and select “Manage My Card”. From there, tap on “Lock/Unlock Card” and enter information to confirm your identity. After confirming, you can lock or unlock your card at any time.

When locked, the card cannot be used for any transactions until it is unlocked again by the customer within the app.

Conclusion

The Walmart MoneyCard app provides a convenient and secure way to manage your money. With the ability to check balances, transfer funds, deposit checks, pay bills, and more all from one place, it offers users an efficient way to keep track of their finances.

Spanish version: Cómo usar la aplicación de la tarjeta de crédito de Walmart y solicitar la tarjeta