We all know mobile banking is big nowadays but not all banking apps are convenient to use. Those who want to get access to their accounts without any hassle will find the Nationwide Mobile Banking app to be the best in the market.

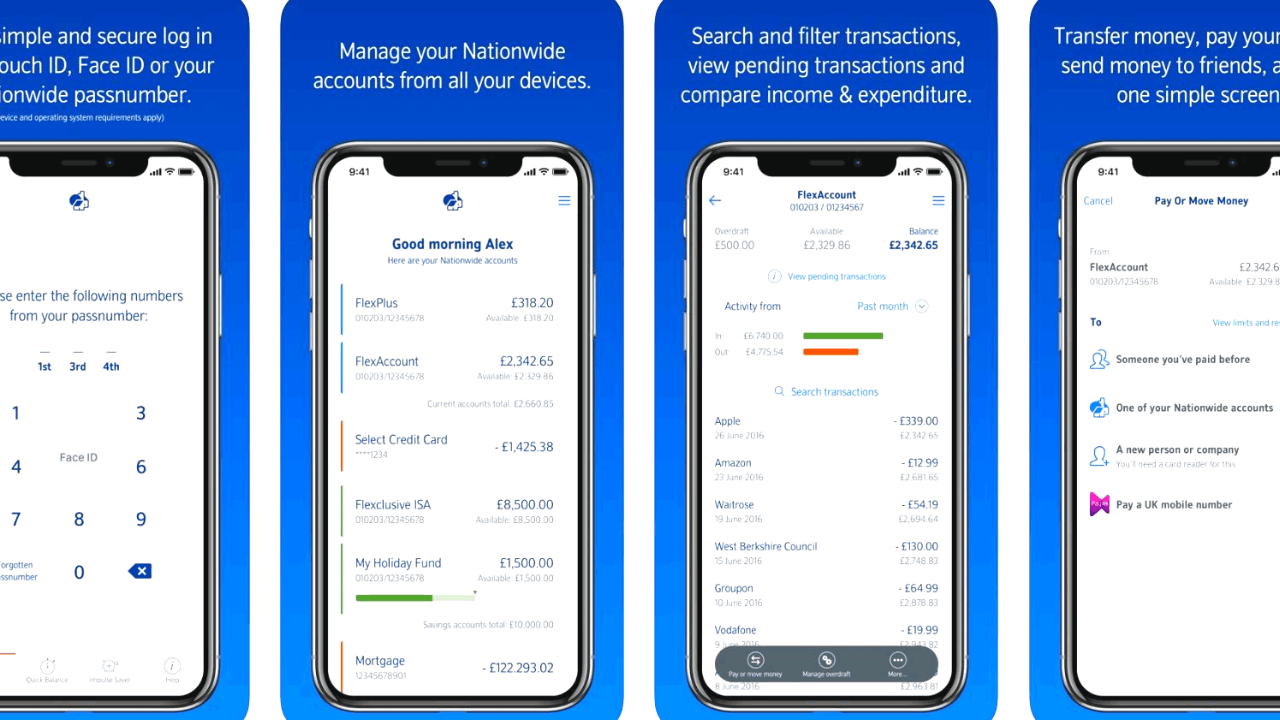

The Nationwide Mobile Banking app offers you a convenient and secure way to manage your finances on the go. With the app, you can easily check your balance, transfer funds, pay bills, apply for a credit card, and deposit checks with just a few taps on your phone. You can access all of your accounts in one place and get real-time notifications about your transactions.

Learn how to use this platform and apply for a credit card with the article down below.

Make Your Life Easier with the Nationwide Mobile Banking App

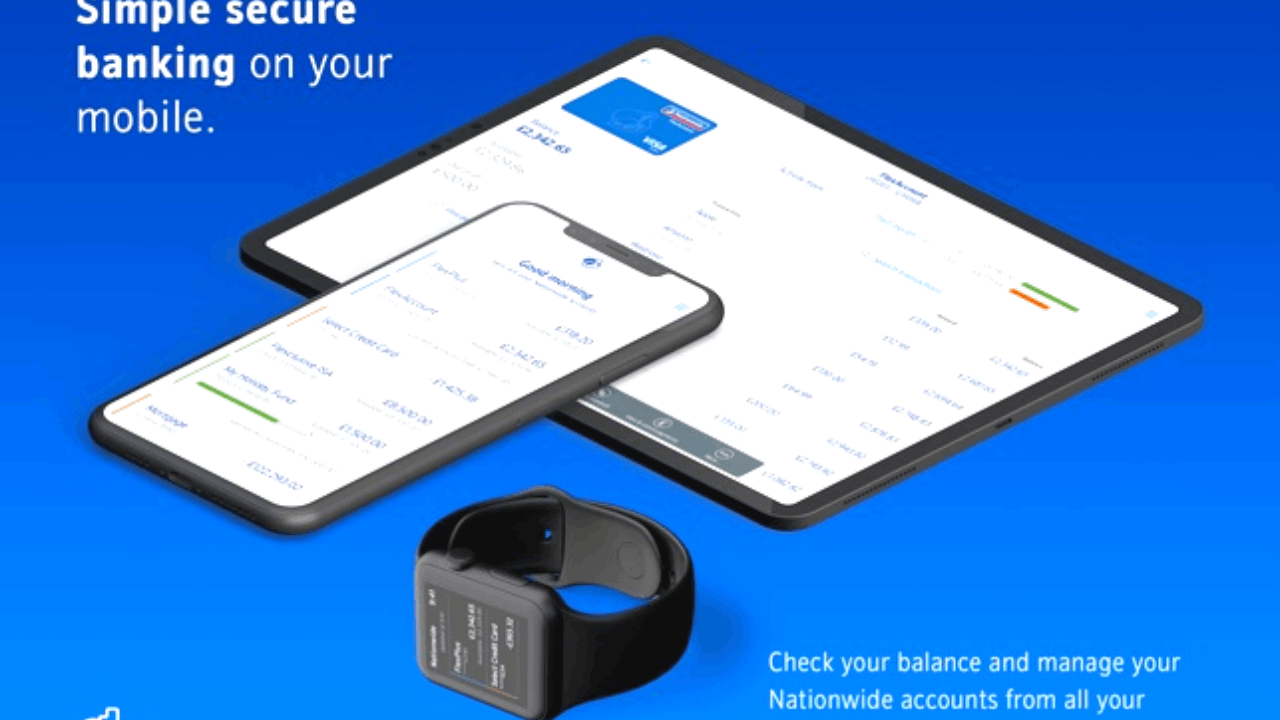

The Nationwide Mobile Banking app provides a convenient and secure way for Nationwide customers to manage their finances on the go.

With the app, users can view their account balances and transaction history, transfer money between accounts, pay bills, and deposit checks using their mobile devices.

The app also has a built-in budgeting tool to help users keep track of their spending. The app offers a wide array of security features including two-factor authentication, Touch ID/Face ID support, and encrypted data storage.

Additionally, users can access customer service through the app by calling or chatting with a representative.

Getting Started with the Nationwide Banking App

Getting started with the Nationwide Mobile Banking app is easy and convenient. The app is available for both iPhone and Android devices. To use the app, download it from an app store and log in using your Nationwide member number and password.

If you don't have this information, you can register for online banking on the Nationwide website, or visit your local branch to register for mobile banking. Once logged in, you'll be able to view all of your accounts, as well as transfer money between them and make payments quickly and securely.

To set up additional features such as alerts, budgeting tools, and access to savings accounts, simply select the Settings option from the main menu. You can also use the app to find nearby ATMs or branches nationwide, check balances on credit cards or loans, and manage investments with ease.

Providing You with a Comprehensive View of Your Account

The Nationwide Mobile Banking app allows customers to easily manage their finances. Customers can view their accounts, check balances, transfer money, and make payments. Customers can also set up alerts for low balances and upcoming payments.

The app provides a comprehensive overview of all of a customer’s accounts in one convenient place. Customers can view their checking accounts, savings accounts, credit cards, loans, and investments.

The Nationwide Mobile Banking app also allows customers to securely send money to other Nationwide members or other banks from within the app. Customers can also set up recurring transfers and manage existing transfers with ease.

The app gives customers the ability to pay bills directly from their accounts in the app. Customers can schedule payments in advance or set up automatic payments for recurring bills. They also have the option to pay select merchants directly from the app using a debit card or linked bank account.

Monitor Every Transaction You Make

The Nationwide Mobile Banking app gives its customers the option to easily manage their finances on the go. The app provides customers with a comprehensive view of their account activity and spending patterns. Customers can view their recent transactions, check account balances, and transfer funds between accounts.

It allows customers to track their spending and set budget goals. Customers can view their spending by categories, such as groceries or entertainment, or by merchant name. This feature also allows customers to set up alerts for when they reach a certain spending limit or when a transaction is made above a certain amount.

This feature also includes a search bar that makes it easy for customers to find specific transactions quickly. Additionally, customers can filter transactions by date range or account type for easier navigation.

Helping You Save Money and Reach Your Goals

The Nationwide Mobile Banking app is a great way to save money and reach your financial goals. You can easily set up a savings goal, track your progress, and even get helpful reminders to keep you on track.

When setting up a savings goal, you can choose how much you want to save each month and when you want to reach your goal. You can also add notes about your goal and track how much you’ve saved so far.

The app also provides helpful reminders that keep you motivated and on track with your savings plan. The Savings Goal feature is easy to use and helps make saving money simple.

It’s a great way to stay focused on reaching your financial goals and take control of your finances. The best part is that this feature is free with a Nationwide Mobile Banking account!

Receive Alerts for Every Activity

The Nationwide Mobile Banking app offers a powerful alerts feature that helps customers stay on top of their finances. Customers can set up alerts for a variety of events, including low balance notifications, when deposits or withdrawals are made, and when payments are due.

The app allows customers to customize alert settings to fit their individual needs. For instance, they can choose how often they receive an alert and the type of notification they want, whether it is through a text message, email, or push notification.

Alerts are a great way for customers to keep track of their financial activity and ensure that their account is secure. By setting up alerts on the Nationwide Mobile Banking app, customers can stay informed about their finances and make sure that no fraudulent activity is occurring on their accounts.

Find Out If You're Eligible for a Nationwide Credit Card

The eligibility requirements to get a credit card on the Nationwide Mobile Banking app depend on the type of card you are applying for.

First, you must be at least 18 years old and a UK resident to apply. You will also need to provide proof of identity, such as a passport or driving license, and proof of address, such as a recent utility bill.

It is also required that you have a good credit score and meet any other criteria set by the company. This could include having a certain level of income or being employed in certain professions. You may also need to have held an account with Nationwide for at least six months before applying for a credit card.

You will need to agree to any terms and conditions set by the company before your application can be approved. Make sure you read these carefully so that you understand what is required of you before signing up for the card.

Applying for a Credit Card Is Now Even Easier

The best part about having the Nationwide Mobile Banking app is the option to apply for a credit card using the app. First, you need to log in to the app and check if you're eligible for a credit card. You can then apply for a new credit card by completing an application form.

You will need to upload several supporting documents such as proof of identity and proof of address. The bank may also ask for other documents during the process.

Once your application has been approved, you will receive a welcome pack in the post with more information about how to use your card and all associated fees. Your new card should arrive within five to seven working days.

Freeze Your Card Using the Nationwide App

Freezing your card through the Nationwide Mobile Banking app is a simple and secure way to protect yourself from fraud.

To freeze your card and prevent any fraudulent activity on your card, log in to the app and select “Cards” at the bottom of the screen. Select the Freeze/Unfreeze Card option and choose the card that you want to freeze.

Your card will be frozen and will not be able to be used for purchases or withdrawals until you unfreeze it again. To unfreeze your card, all you need to do is to reverse the process and choose “Unfreeze card”.

It will now be ready for use again and can be used for purchases and withdrawals as normal. Be sure to check first that you are clear of any fraudulent activity before you reactivate your card.

How to Report Your Card Lost or Stolen

If you have lost or had your Nationwide card stolen, you can report it quickly and easily through the Nationwide Mobile Banking app. Tap the Cards option at the bottom of the screen and select the card that has been lost or stolen from the list of cards associated with your account.

Choose “Report Lost/Stolen Card” and follow the procedure to complete the process. Once you have reported your card, you will be able to order a new one through the app or by contacting Nationwide customer service.

By reporting your lost or stolen card quickly, you can help protect yourself from any unauthorized transactions that may occur on your account due to fraud or theft.

Conclusion

The Nationwide Mobile Banking app is a great tool for anyone who wants easy and convenient access to their banking services. It offers a user-friendly interface and helpful features such as mobile deposits, bill pay, transfers, and more. With its secure authentication and encryption, users can rest assured that their information is protected.

Download the app today from the Google Play Store or the Apple App Store.